Hop brokers are watching you. Could making a quick buck jeopardize your hop contracts? Recently, we heard from a brewer who has been selling proprietary varieties at some pretty high prices…

I shared a different point of view with this brewer and I’d like to share it with you too…

1. Part of the hop broker’s (very important) role is to match supply to demand. Anyone who was brewing in 2009 knows that the entire industry pays for it whenever the system gets too far out of balance. Facilitating balance (aka market allocations) is a large part of why we built The Lupulin Exchange. Most brokers offer forward contracting to ease the cashflow burden on brewers, while improving their ability to forecast demand.

2. Attempts to leverage the broker’s risk for personal gain will be short-lived and probably won’t end well. Brokers take on a lot of risk. Historically, brewers bid with brokers and then had to pay for and store the entire crop year at the brewery! Modern day brokers make gigantic investments to build hop processing and refrigerated storage facilities. Brokers pay growers at harvest for the entire crop year, then pelletize, pack, store, and refrigerate those hops. Today’s brewer only pays when placing an order for delivery - this is a privilege, not a right, so don’t abuse it.

3. You reap what you sow. Most brokers only want to sell you hops that you’re actually going to turn into beer. Some brokers are now requiring down payments on forward contracts due to recent abuses. Other brokers are now devoting more resources to analyzing each brewer’s actual needs/usage (ie reported barrelage, year over year growth, brewery capacity, tracking customer Hop Alerts on LEx, etc.).

4. Don’t be the last one holding the bag. We’re all in the business of making beer, not day trading hops. I borrow the following advice from Bart Watson at the Brewers Association and strongly suggest that you follow it.

The efficiency of these changes brings me to my penultimate point: don’t try to beat the market. I’ve been hearing some scary stories out there about brewers contracting well above their forecasted demand in the future, with the attitude that “even though I probably won’t need them, I’m sure I can sell them for a profit down the line”. Don’t be so sure of that. Historically, hops prices have been incredibly sensitive to demand. When there is a shortage, they tend to rise very quickly. On the flip side, when there is a surplus, prices can drop rapidly. This is why accurate contracting is so important for both sides (dealers and brewers). Contracting more than you need raises the specter of being the last one holding the hops when the music ends.

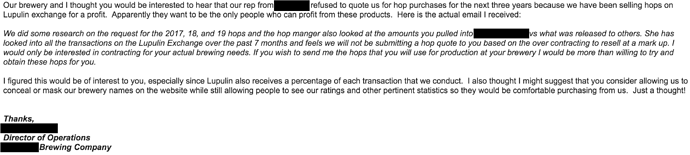

The Lupulin Exchange was built to give commercial brewers a more convenient way to even out hop positions. The intent was never to allow brewers to generate income from a side business as hop scalpers. The vast majority of brewers who use LEx to unload overages do so at cost, and more and more buyers are getting the message: Don’t Overpay for Hops. To help guide buyers, we’ve got some new features in development. For example: recent high, low, and ave trading prices will soon be displayed on both Hop Alerts and listing pages for the given combination of variety, CY, and hop product (T90, leaf, etc).