Last quarter, we asked brewers some questions. I was hoping to present the results during the 2024 Hop Growers of America Convention, but the organizers ghosted me when I asked for a few minutes to present. ![]() I figured this type of information would be of interest to the hop growers, merchants, and brewers who attend HGA, but that’s ok…Instead, I’ll just post the results here as I make the annual pilgrimage to HGA. Alright, on to the results…

I figured this type of information would be of interest to the hop growers, merchants, and brewers who attend HGA, but that’s ok…Instead, I’ll just post the results here as I make the annual pilgrimage to HGA. Alright, on to the results…

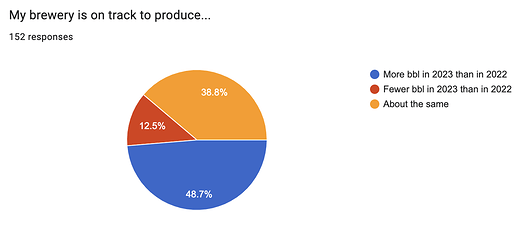

The giant blue slice of respondents reporting “more” surprises me and doesn’t agree with the production decline anticipated by the BA.

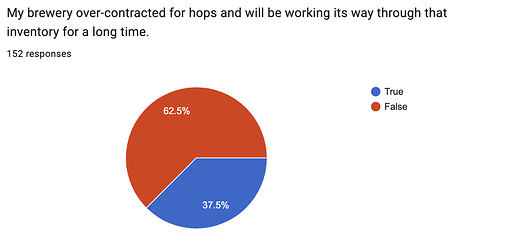

This next one also surprised me because I feel like every brewer I’ve talked to this year is drowning in hops they don’t need…

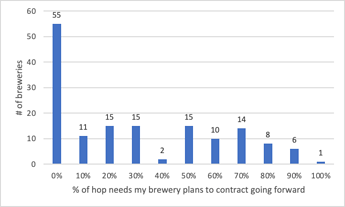

We also asked breweries about their anticipated forward contracting rates:

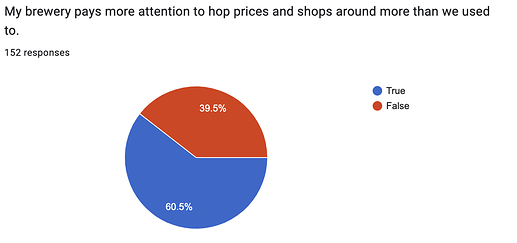

Are brewers becoming more price-sensitive?

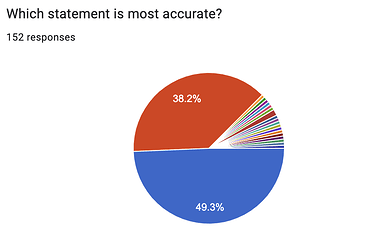

We also asked brewers to what extent they closely follow the hop industry and have a strong understanding of market dynamics, including the current >40 million pound surplus that Alex Barth announced this time last year during HGA.

- 49% (in blue below) said they closely followed & understood

- 38% (red) said they don’t pay attention & aren’t well-informed

- Everyone else (~13%) said they fell somewhere in between

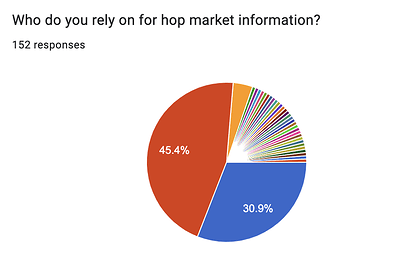

Next, we asked from whom brewers get their information & to what extent they trust the source. Those were some pretty interesting responses.

- 45.4% (in red below) indicated that they get most of their information from hop dealers and/or growers but don’t fully trust them.

- 30.9% (in blue) indicated that they get most of their information from hop dealers and/or growers and fully trust what they have to say.

- 3.9% (orange) indicated that they read the MacKinnonReport and believe that hop dealers and/or growers take advantage of brewers.

Out of the remaining responses (~20%), only 3 other sources were mentioned more than once:

- The BA (mentioned by 3 respondents)

- Stan Hyronimous newsletter (mentioned by 2 respondents)

- Reddit (mentioned by 2 respondents)

Then, there’s my favorite response: “I gather data from these sources (including my magic 8 ball), analyze it, chew on it, and then make a panicked purchase of hops one week after I should have.”